💰 Find the best interest rates on savings accounts in the USA (2025) with up to 4.80% APY. Compare top banks, interest rates, & benefits. Start saving today!

Are you looking for the best high-yield savings accounts in the USA? A high-interest savings account can help you grow your money faster while keeping it safe.

As of March 2025, the national average savings account interest rate is around 0.41% (FDIC report), but some banks offer 4.50% – 5.00% APY or more!

In this guide, we will compare the best savings accounts with the highest interest rates in the USA, their benefits, features, and how to open an account.

1️⃣ What is a High-Yield Savings Account?

A high-yield savings account (HYSA) is a bank account that offers a much higher interest rate (APY) compared to a regular savings account.

🔹 Key Benefits of High-Yield Savings Accounts:

✔ Higher Interest Rates – Earn 10-15x more than regular savings accounts.

✔ Safe & Secure – FDIC-insured up to $250,000 per depositor.

✔ Easy Access to Funds – Withdraw money anytime.

✔ No Risk – Unlike stocks or crypto, your money remains secure.

2️⃣ Best Interest Rates on Savings Accounts in the USA (2025)

Here are the top banks and online financial institutions offering the best interest rates on savings accounts in 2025:

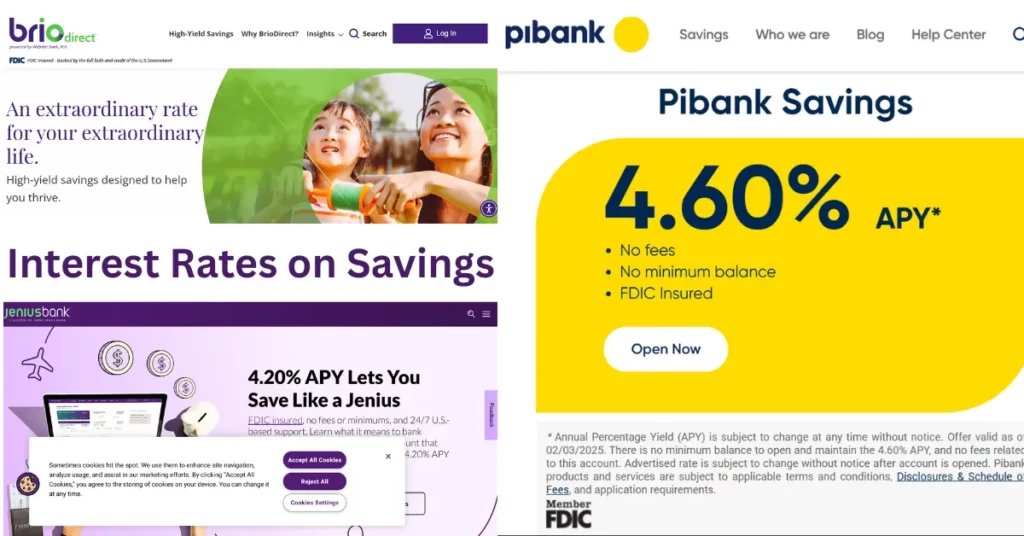

🏦 1. Jenius Bank – 4.80% APY

✅ APY: 4.80%

✅ Minimum Balance: None

✅ Monthly Fees: $0

✅ Special Feature: Unlimited transfers

➡ Website: Jenius Bank

🏦 2. BrioDirect – 4.75% APY

✅ APY: 4.75%

✅ Minimum Balance: $5,000

✅ Monthly Fees: $0

✅ Special Feature: High returns for large deposits

➡ Website: BrioDirect

🏦 3. OpenBank – 4.75% APY

✅ APY: 4.75%

✅ Minimum Balance: $500

✅ Monthly Fees: $0

✅ Special Feature: Mobile banking & digital savings

➡ Website: OpenBank

🏦 4. Pibank – 4.60% APY

✅ APY: 4.60%

✅ Minimum Balance: None

✅ Monthly Fees: $0

✅ Special Feature: No restrictions on withdrawals

➡ Website: Pibank

🏦 5. My Banking Direct – 4.55% APY

✅ APY: 4.55%

✅ Minimum Balance: $500

✅ Monthly Fees: $0

✅ Special Feature: Mobile app with auto-saving options

➡ Website: My Banking Direct

Best High-Yield Savings Account Rates for June 2025

- Varo Bank – 5.00% APY.

- Adelfi – 5.00% APY.

- Fitness Bank – 5.00% APY.

- Axos Bank – 4.66% APY.

- Pibank – 4.60% APY.

- OMB – 4.56% APY.

- Vibrant Credit Union – 4.50% APY.

- Presidential Bank – 4.50% APY.

3️⃣ How to Choose the Best Savings Account?

When selecting a high-yield savings account, consider the following factors:

✔ Interest Rate (APY): The higher, the better!

✔ Minimum Deposit Requirement: Choose a bank with a deposit that fits your budget.

✔ Monthly Fees: Always go for no-fee accounts to maximize savings.

✔ Withdrawal Limits: Some banks restrict the number of withdrawals per month.

✔ Customer Support & Mobile App: A smooth banking experience is essential.

4️⃣ How to Open a High-Yield Savings Account? (Step-by-Step Guide)

Opening a high-yield savings account in the USA is easy and can be done entirely online.

✅ Step 1: Choose the Best Bank

Compare the banks listed above and pick the one that suits your needs.

✅ Step 2: Gather Required Documents

Valid ID (Passport, Driver’s License, or SSN)

Proof of Address (Utility Bill, Lease, etc.)

Initial Deposit Amount (if required)

✅ Step 3: Apply Online

Visit the bank’s official website and fill out the application form.

✅ Step 4: Fund Your Account

Deposit the minimum required balance to activate your account.

✅ Step 5: Start Earning Interest

Once your savings account is open, let your money grow with high-interest rates!

5️⃣ Frequently Asked Questions (FAQs)

What is the best savings account interest rate in the USA?

Currently, Jenius Bank offers one of the highest savings interest rates at 4.80% APY.

Can I lose money in a high-yield savings account?

No, savings accounts are FDIC-insured, which means your money is protected up to $250,000 per depositor.

How many times can I withdraw money from a high-yield savings account?

Most banks allow up to 6 withdrawals per month without penalties.

Are online savings accounts safe?

Yes! Banks like BrioDirect, Jenius Bank, and OpenBank are FDIC-insured and use high-level encryption for security.

How much interest can I earn in a year?

If you deposit $10,000 in a savings account with 4.80% APY, you will earn $480 per year in interest!

Which bank gives 7% interest on savings accounts?

Currently, there’s no bank offering a 7% APY on savings accounts. However, some credit unions might offer 7% or higher interest rates on checking accounts.

Where can I get 7% interest on savings?

Provider Rate (AER) How to open

First Direct: 7% fixed for one year Online/ app

Co-operative Bank: 7% variable for one year Online/ branch

Nationwide: 6.5% variable for one year Online/ app

Lloyds Bank: (need a Club Lloyds account) 6.25% fixed for one year Online/ app/ branch/ phone

Keep in mind that interest rates may vary depending on the balance amount and type of account. It’s essential to check with the banks for the most up-to-date information

🔥 Conclusion – Which is the Best High-Yield Savings Account?

If you want the highest interest rate, go for Jenius Bank (4.80% APY).

If you prefer a bank with no minimum deposit, choose Pibank (4.60% APY).

If you are depositing $5,000 or more, BrioDirect (4.75% APY) is a great option!

Best Interest Rates on Savings Accounts in the USA for March 2025

- Pibank – 4.60% APY.

- Fitness Bank – 4.55% APY*

- Vibrant Credit Union – 4.50% APY.

- BrioDirect – 4.50% APY.

- Poppy Bank – 4.50% APY.

- TotalBank – 4.47% APY.

- Vio Bank – 4.46% APY.

- Newtek Bank – 4.45% APY.

💡 Final Tip: Always check for updated interest rates, as banks may change them frequently.

Read also:-

Ash Tsai biography, age, height, net worth & moreVicky Kaushal Biography, Height, Age, Girlfriend, WifeShivani Baokar Biography, Age, Net Worth, WikiEmma Heming Willis Biography

Do you have anything to add to the Best Interest Rates on Savings Accounts in the USA (2025 Guide) Please share your valuable feedback. Use the comment section below.